Ekens Foundation Annual Report

T2-SCH 100E (18) CODE 0802 Annual Audits and Financial Report Balance Sheet

Thank you for reading this post, don't forget to subscribe!

2018 ANNUAL REPORT

EKENS FOUNDATION INTERNATIONAL 2018

AUDITS, BALANCE SHEET, FINANCIAL REPORT.

Account Description

CURRENT ASSETS

- Current Assets: Code: 1000: Type: Funds: Amount: $152,786.90

- Current Assets: Code: 1001: Type: Funds: Amount: $55,000.00

- Current Assets: Code: 1060: Type: Account Receivable: Amount: $58,960.80

- Current Assets: Code: 1062: Type: Trade Account Receivable: Amount: $0.00

- Current Assets: Code: 1066: Type: Tax Receivable: Amount: $0.00

- Current Assets: Code: 1120: Type: Inventories: Amount: $32,600.00

- Current Assets: Code: 1180 Type: Shot Terms Investments: Amount $0.00

- Current Assets: Code: 1181: Type: Canadian Term Deposits: Amount: $0.00

- Current Assets: Code: 1484 Type: Prepaid Expenses: Amount $270,649.00

- Current Assets: Code: 1519 Type: Total Amount $18,690.78

- Current assets: Total Account Receivable $58,960.80

CAPITAL ASSETS

- Capital Assets: Code 1600:Type: Land: Amount $0.00

- Capital Assets: Code: 1690: Type: Buildings: Amount: 0.00

- Capital Assets: Code: 1681: Type: Accumulated Amortization of Buildings: Amount: $0.00

- Capital Assets: Code: 1742: Type: Motor Vehicles Amount: $15,000.00

- Capital Assets: Code: 1743: Type: Accumulated Amortization of Motor Vehicles: Amount: $0.00

- Capital Assets: Code: 1774: Type: Computer Equipment/Software: Amount: $4,000.00

- Capital Assets: Code: 1775: Type: Accumulated Amortization of Computers: Amount: $0.00

- Capital Assets: Code: 1785: Type: Furniture and Fixture: Amount: $2,100.00

- Capital Assets: Code: 1788: Type: Accumulated Amortization of Furniture: Amount: $0.00

- Capital Assets: Code: 1918: Type: Leasehold Improvements: Amount: $0.00

- Capital Assets: Code: 1919: Type: Accumulated Amortization of Leasehold: Amount: $0.00

- Capital Assets: Code: 2008: Type: Total Tangible Assets: Amount: $0.00

- Capital Assets: Code: 2009: Type: Accumulated Amortization of Total Tangible Assets: Amount: $0.00

- Capital Assets: Code: 1212: Type: Goodwill: Amount: $0.00

- Capital Assets: Code: 1213: Type: Accumulated Amortization of Goodwill: Amount: $0.00

- Capital Assets: Code: 2018: Type Incorporation Cost: Amount: $1,300.00

- Capital Assets: Code: 2019: Type: Accumulated Amortization of Incorporation: Amount: $0.00

- Total Capital Assets: $22,400.00

CURRENT LIABILITIES

- Current Liabilities: Code: 2600: Type: Bank Overdraft Amount: $0.00

- Current Liabilities: Code: 2621: Type: Trade Payable: Amount: $0.00

- Current Liabilities: Code: 2624: Type: Bank Wages Payable: Amount: $2,132.00

- Current Liabilities: Code: 2626: Type: Bonus payable Amount: $0.00

- Current Liabilities: Code: 2680: Type: Tax payable: Amount: $317.21

- Current Liabilities: Code: 2780: Type: Due to shareholders and Directors Amount: $0.00

- Current Liabilities: Code: 3139: Type: Current Portion of Long Term :Amount: $0.00

LONG TERM LIABILITIES

- Long Term Liabilities: Code: 3500: Type: Long term debts :Amount: $55,888.00

- Long Term Liabilities: Code: 3240: Type: Future deferred income tax: Amount: $0.00

- Long Term Liabilities: Code: 3260: Type: Due to shareholders and Directors Amount: $0.00

- Long Term Liabilities: Code: 3300: Type: Due to related Parties Amount: $0.00

- Long Term Liabilities: Code: 3499: Type: Total liabilities Amount: $0.00

SHAREHOLDERS EQUITY

- Shareholders Equity: Code: 3500: Type: Common Shares: Amount: $0.00

- Shareholders Equity: Code:3520: Type: Preferred Shares: Amount: $0.00

- Shareholders Equity: Code:3541: Type: Contributed Surplus: Amount: $0.00

- Shareholders Equity: Code:3600: Type: Retained Earning/Deficit: Amount: $0.0

- Shareholders Equity: Code:3640: Type: Total Liabilities and Shareholders: Amount: $0,00

RETAINED EARNING

- Retained Earning: Code: 3660: Type: Retained Earning/Deficit/Star.: Amount: $0.00

- Retained Earning: Code: 3680: Type: Net Income/Loss: Amount: $266,746.00

- Retained Earning: Code: 3700: Type: Dividends Declared: Amount: $0.00

- Retained Earning: Code: 3849: Type:

- Retained Earning/Deficit and: Amount: $0.00

LONG TERM INVESTMENT

- Long Term Investment: Code: 2240: Type: Due Frim and Investment in Related: Amount: Amount: $0.00

- Long Term Investment: Code: 2300: Type: Long Term Investments: Amount: $0.00

- Long Term Investment: Code: 2360: Type: Long Term Loans: Amount: $55,888.00

- Long Term Investment: Code: 2589: Type: Total Long Term Assets Amount: Amount: $0.00

- Long Term Investment: Code: 2599: Type: Total Assets: Amount: Amount: $0.00

- This 2018 Ekens Foundation International, was audited by professional and certified accountants

- And was approved and adopted by the Board Members of Ekens Foundation

- Before the Revenue Canada T-2 Income Tax, under the Non Soliciting Non-Profits Organization.

2019 ANNUAL REPORT

EKENS FOUNDATION INTERNATIONAL 2019

AUDITS, BALANCE SHEET, FINANCIAL REPORT.

Account Description

CURRENT ASSETS

- Current Assets: Code: 1000: Type: Funds: Amount: $223,433.50

- Current Assets: Code: 1001: Type: Funds: Amount: $140,000.00

- Current Assets: Code: 1060: Type: Account Receivable: Amount: $31,446.75

- Current Assets: Code: 1062: Type: Trade Account Receivable: Amount: $0.00

- Current Assets: Code: 1066: Type: Tax Receivable: Amount: $30,999.16

- Current Assets: Code: 1120: Type: Inventories: Amount: $22,107.37

- Current Assets: Code: 1180 Type: Shot Terms Investments: Amount $0.00

- Current Assets: Code: 1181: Type: Canadian Term Deposits: Amount: $0.00

- Current Assets: Code: 1484 Type: Prepaid Expenses: Amount $519,000.00

- Current Assets: Code: 1519 Type: Total Amount $15,956.35

- Current assets: Total Account Receivable $62,445.91

CAPITAL ASSETS

- Capital Assets: Code 1600:Type: Land: Amount $0.00

- Capital Assets: Code: 1690: Type: Buildings: Amount: 0.00

- Capital Assets: Code: 1681: Type: Accumulated Amortization of Buildings: Amount: $0.00

- Capital Assets: Code: 1742: Type: Motor Vehicles Amount: $12,000.00

- Capital Assets: Code: 1743: Type: Accumulated Amortization of Motor Vehicles: Amount: $0.00

- Capital Assets: Code: 1774: Type: Computer Equipment/Software: Amount: $6,200.00

- Capital Assets: Code: 1775: Type: Accumulated Amortization of Computers: Amount: $0.00

- Capital Assets: Code: 1785: Type: Furniture and Fixture: Amount: $3,389.00

- Capital Assets: Code: 1788: Type: Accumulated Amortization of Furniture: Amount: $0.00

- Capital Assets: Code: 1918: Type: Leasehold Improvements: Amount: $0.00

- Capital Assets: Code: 1919: Type: Accumulated Amortization of Leasehold: Amount: $0.00

- Capital Assets: Code: 1788: Type: Total Eligible Assets: Code: 1788

- Capital Assets: Code: 2008: Type: Accumulated Amortization of Total Eligible Assets:

- Capital Assets: Code: 1212: Type: Goodwill: Amount: $0.00

- Capital Assets: Code: 1213: Type: Accumulated Amortization of Goodwill: Amount: $0.00 Amount: $0.00

- Capital Assets: Code: 2018: Type Incorporation Cost: Amount: $1,300.00

- Capital Assets: Code: 2019: Type: Accumulated Amortization of Incorporation: Amount: $0.00

LONG TERM INVESTMENT

- Long Term Investment: Code: 2240: Type: Due From/Investment in Related Parties: Amount: $0.00

- Long Term Investment: Code: 2230: Type: Long Term Investments: Amount: $0.00

- Long Term Investment: Code: 2360: Type: Long Term Loans: Amount: $31,425.00

- Long Term Investment: Code: 2589: Type: Total Long Term Assets: Amount: $0.00

- Long Term Investment: Code: 2599: Type: Total Assets: Amount:

CURRENT LIABILITIES

- Current Liabilities: Code: 2600: Type: Bank Overdraft Amount: $0.00

- Current Liabilities: Code: 2621: Type: Trade Payable: Amount: $0.00

- Current Liabilities: Code: 2624: Type: Bank Wages Payable: Amount: $8,108.09

- Current Liabilities: Code: 2626: Type: Bonus payable Amount: $0.00

- Current Liabilities: Code: 2680: Type: Tax payable: Amount: $10,083.76

- Current Liabilities: Code: 2780: Type: Due to shareholders and Directors Amount: $0.00

- Current Liabilities: Code: 3139: Type: Current Portion of Long Term :Amount: $0.00

LONG TERM LIABILITIES

- Long Term Liabilities: Code: 3500: Type: Long term debts :Amount: $31,425.00

- Long Term Liabilities: Code: 3240: Type: Future deferred income tax: Amount: $0.00

- Long Term Liabilities: Code: 3260: Type: Due to shareholders and Directors Amount: $0.00

- Long Term Liabilities: Code: 3300: Type: Due to related Parties Amount: $0.00

- Long Term Liabilities: Code: 3499: Type: Total liabilities Amount: $0.00

SHAREHOLDERS EQUITY

- Shareholders Equity: Code: 3500: Type: Common Shares: Amount: $0.00

- Shareholders Equity: Code:3520: Type: Preferred Shares: Amount: $0.00

- Shareholders Equity: Code:3541: Type: Contributed Surplus: Amount: $0.00

- Shareholders Equity: Code:3600: Type: Retained Earning/Deficit: Amount: $0.0

- Shareholders Equity: Code:3640: Type: Total Liabilities and Shareholders: Amount: $0,00

RETAINED EARNING

- Retained Earning: Code: 3660: Type: Retained Earning/Deficit/Star.: Amount: $4,571.35

- Retained Earning: Code: 3680: Type: Net Income/Loss: Amount: $524,000.00

- Retained Earning: Code: 3700: Type: Dividends Declared: Amount: $0.00

- Retained Earning: Code: 3849: Type:

- Retained Earning/Deficit and: Amount: $0.00

UNCATEGORIED

- Uncategorized Assets: Code: XXXX: Type:

- Uncategorized Assets: :Amount: $9,000.00

- Uncategorized Assets: Code: XXXX: Type: Undeposited Funds: Amount: $4,300.00

- Uncategorized Assets: Code: XXX: Type: Private Insurances: $16,000.00

- Uncategorized Assets: Code: XXXX: Type: Bad Debt: Amount: $10,790.00

- Uncategorized Assets: Code: XXX: Type: Discounts Given: Amount: $2,864.85

- This 2019 Ekens Foundation International, was audited by professional and certified accountants

- And was approved and adopted by the Board Members of Ekens Foundation

- Before the Revenue Canada T-2 Income Tax, under the Non Soliciting Non-Profits Organization.

2020 ANNUAL REPORT

EKENS FOUNDATION INTERNATIONAL 2020

AUDITS, BALANCE SHEET, FINANCIAL REPORT.

In Audit and shall be published soon, please check us back.

2021 ANNUAL REPORT

Check us back

New Accordion Tab

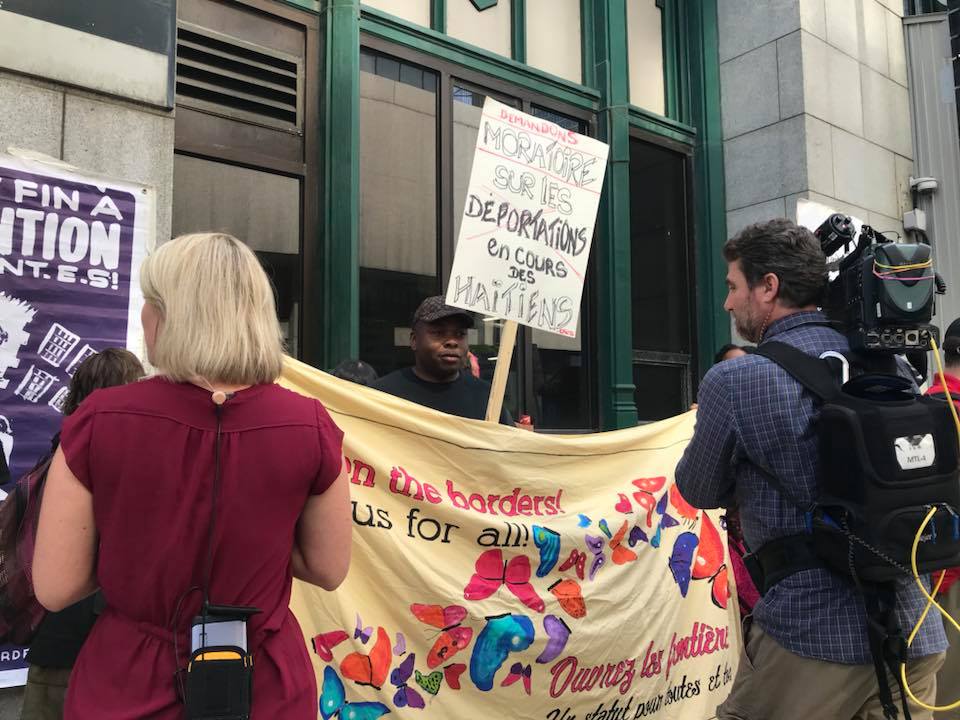

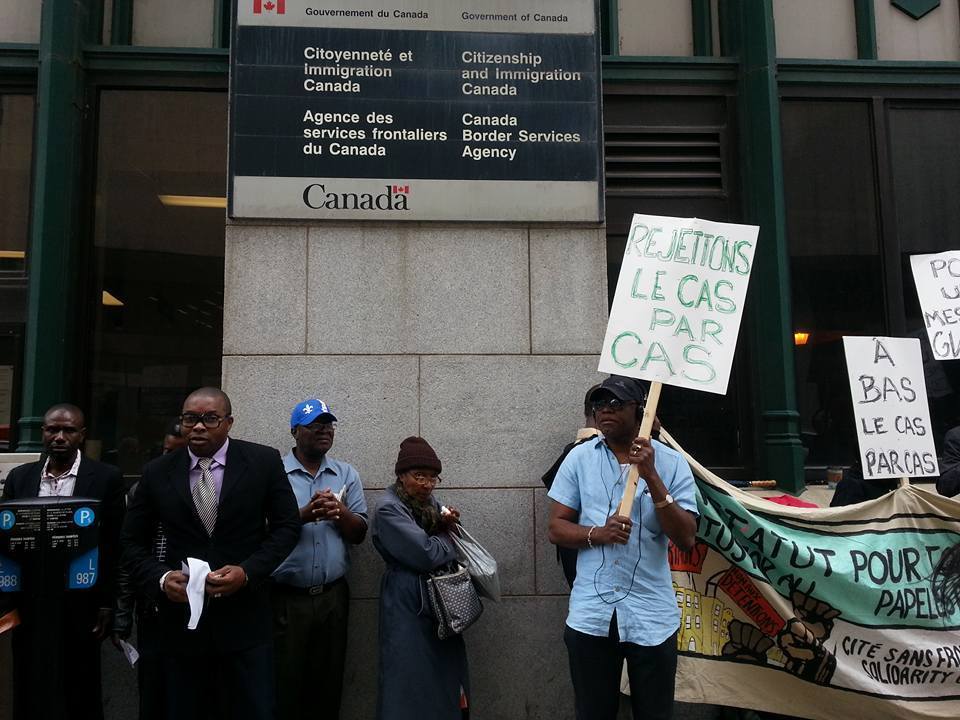

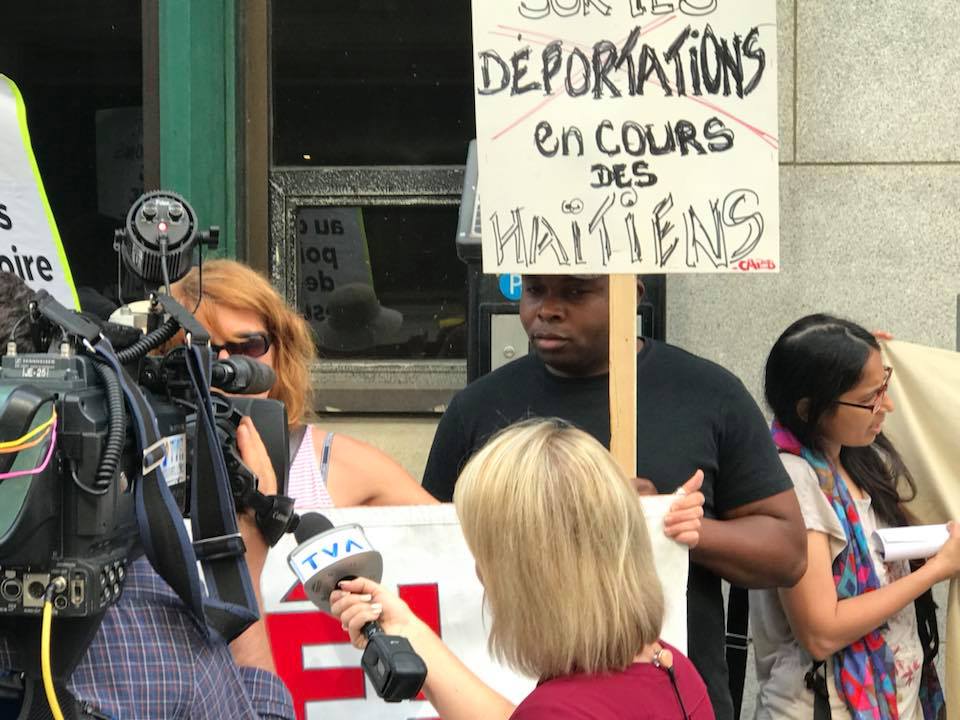

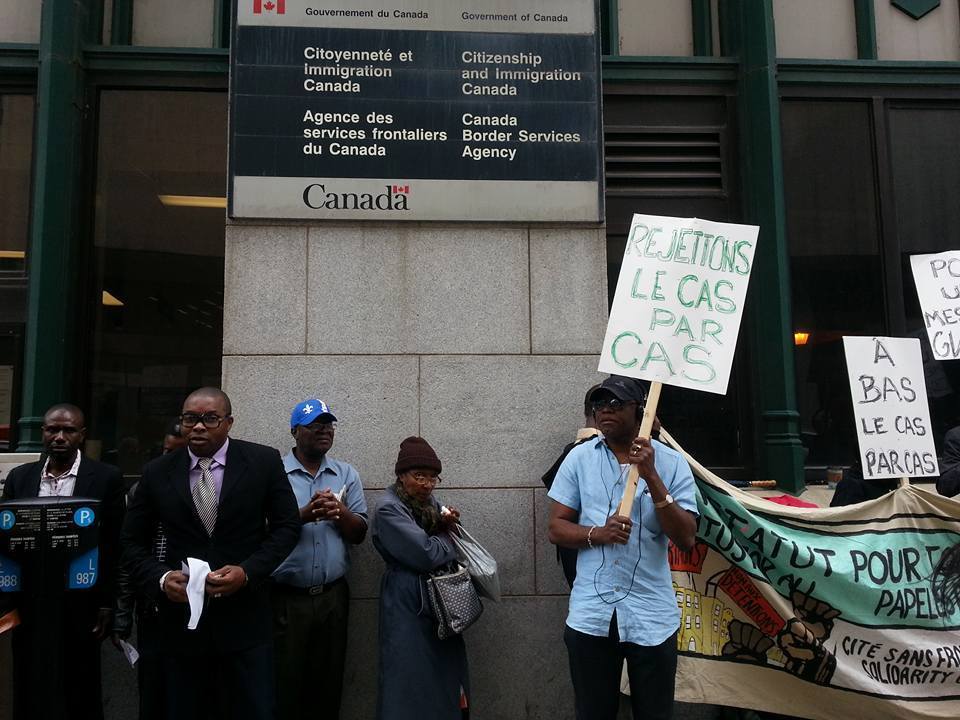

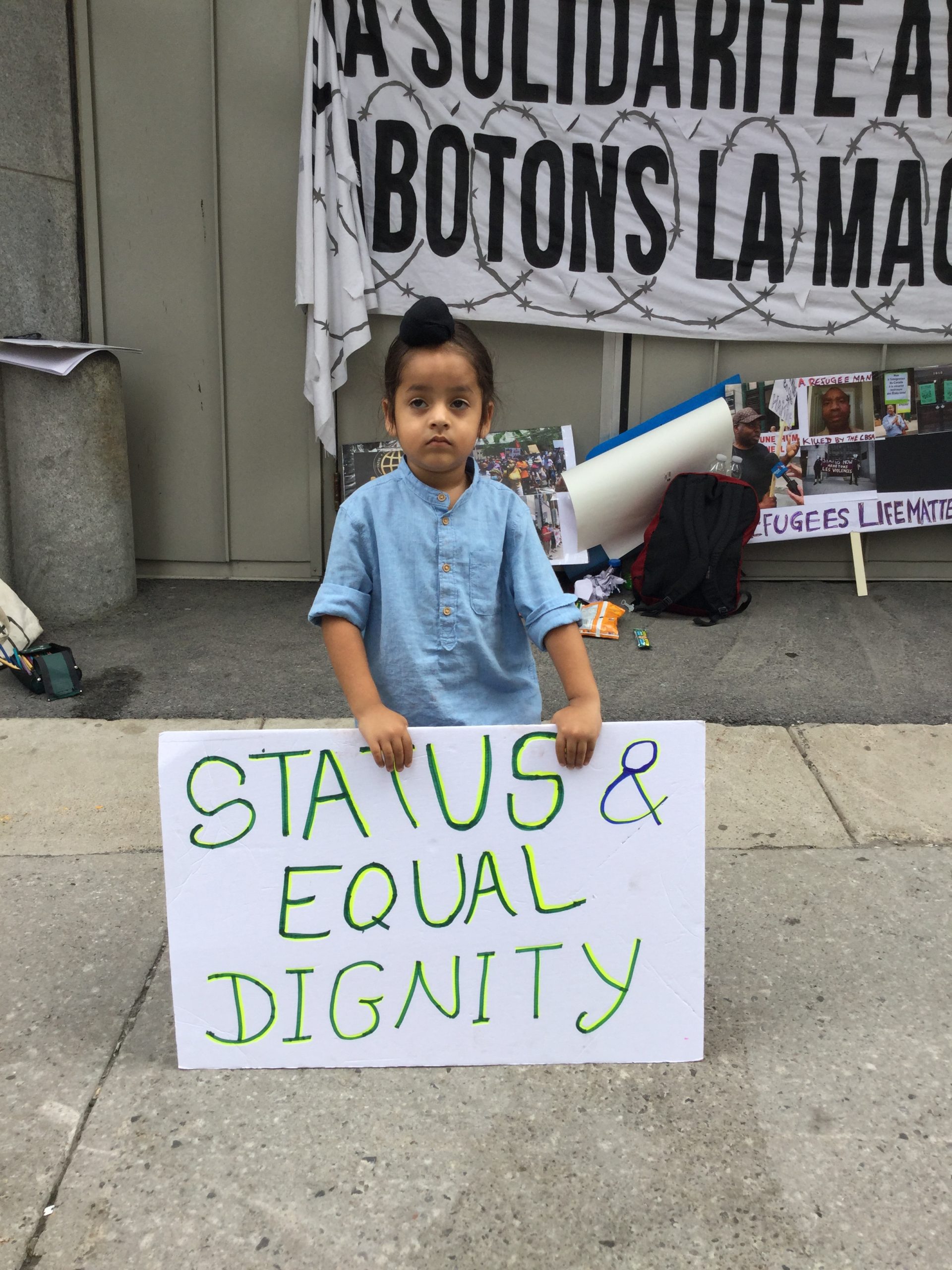

Refugee Hearing

Become Volunteer

New Immigration Prison

Daylight Kidnapping Elderly Woman Austrian City According to the Austrian Police,

Presentation of funds to the Pamala Anderson Foundation at Brian Thomas Dublin 2, Dublin, Ireland